A.I. Portfolio Battle: ChatGPT vs. Deepseek Week 1

If you missed the first post, I’m running a six month experiment to see whether ChatGPT or Deepseek could beat the market with a micro-cap portfolio. Before the first update, I have to be real with you guys.

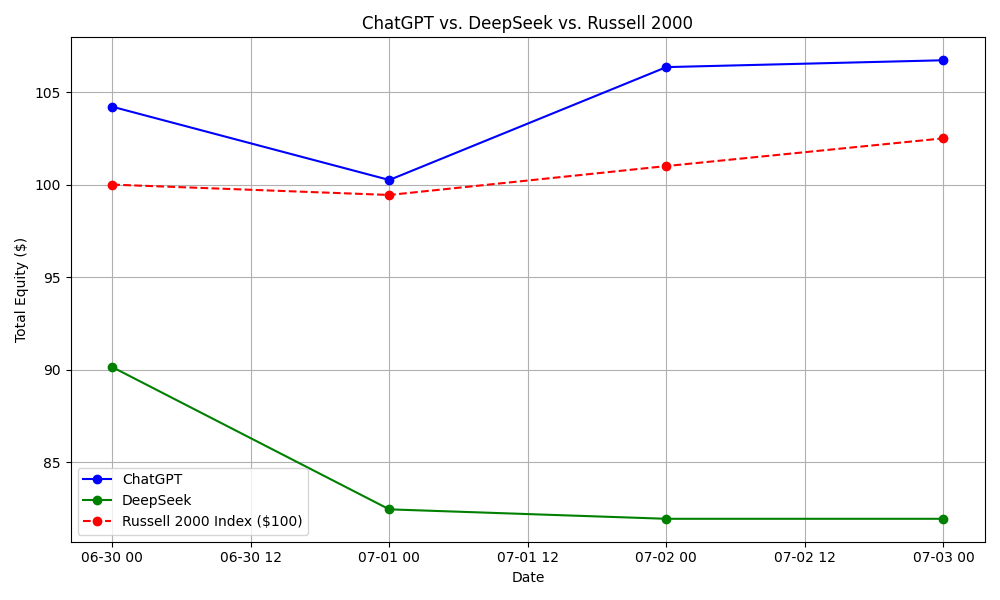

DeepSeek did bad. Like -20% first week bad. I realize if nothing changes it’s going to a six month humiliation ritual for DeepSeek. So, I will be cutting DeepSeek out of the experiment. Your 20% downturn in five days will never be forgotten, DeepSeek.

Overall, ChatGPT had a first great week! It even outperformed the Russell 2000. CSAI (Cloudastructure Inc) was the MVP with a 12% increase. However, It’s other two picks stayed stagnant. Of course, we already know how DeepSeek’s went.

ChatGPT’s Performance: +6.72%

DeepSeek’s Performance: -18.06%

Now for ChatGPT’s portfolio update:

ChatGPT’s Changes:

ABEO (Abeona Therapeutics) – Hold

FDA-approved gene therapy launching now. $225M cash. Recently added to Russell 2000. Undervalued. Big upside if early sales impress.CADL (Candel Therapeutics) – Hold

Strong Phase 3 cancer data. $100M cash runway. Multiple ongoing trials. Q4 glioma data could be a major catalyst.AZTR (Azitra, Inc.) – Buy

~$4M market cap. Phase II/III trial for rare skin disease (RDEB) ends Q4. Interim data showed 60% wound healing vs. 15% placebo. High-risk moonshot with potential for 10x+ upside.

Sold: CSAI – Lacked short-term catalyst. Capital reallocated into AZTR for higher return potential.

Cash Remaining: ~$20

Thought Process:

Clear Q3–Q4 catalysts across all holdings

High short interest could fuel squeeze rallies

Focused on biotech for asymmetric return potential

Will ChatGPT continue to outperform? Will it fall into the depths with DeepSeek? Check back next weekend for the update and thank you for reading!

Hello Nathan,

How many share of AZTR have you bought (and at what price) ?

Hello!

Thank you for posting your journey and encouraging people like me to start their own test 🙌

I have a question regarding this week activity: "Sold: CSAI – Lacked short-term catalyst. Capital reallocated into AZTR for higher return potential."

Did ChatGPT recommend you to do it? Or was a decision taken by yourself?

Thank you!