ChatGPT's Micro-cap Portfolio: Week 5

Heavy Week...

Recap

Hey guys! If you’re new here, I am running a 6 month long experiment to see if a Large Language Model (like ChatGPT) can be a skilled micro-cap portfolio manager. I give it real data (closing price, volume, etc.) at the end of every trading day, and it has full control over its assets. Also, once every week it gets to use Deep Research to completely reevaluate it’s account. Can ChatGPT carve out consistent alpha in the dangerous world of micro-cap stocks? Lets find out.

Overview

This week was a struggle across most of the market, and ChatGPT’s portfolio was no exception. The week started out rough; as none of planned orders went through. It’s order limit sell order of AZTR did not get executed, as the stock took a deep hit on Monday; it was then forced to move to a worse price the next day.

Also, the A.I. wanted to place a limit buy order of AXGN for $7.00. The close previously on Friday was ~$13. Shockingly, the market did not let ChatGPT buy for almost half price. After the failed orders, the model decided to play more defensive. After the AZTR sale, it decided to keep most of it in cash, only buying another two shares of IINN for only at total of ~$4. It also made the decision to reduce the position in ABEO from six shares to four, citing a support break near the end of the week. So, on Friday, it was sitting on $32 dollars in cash.

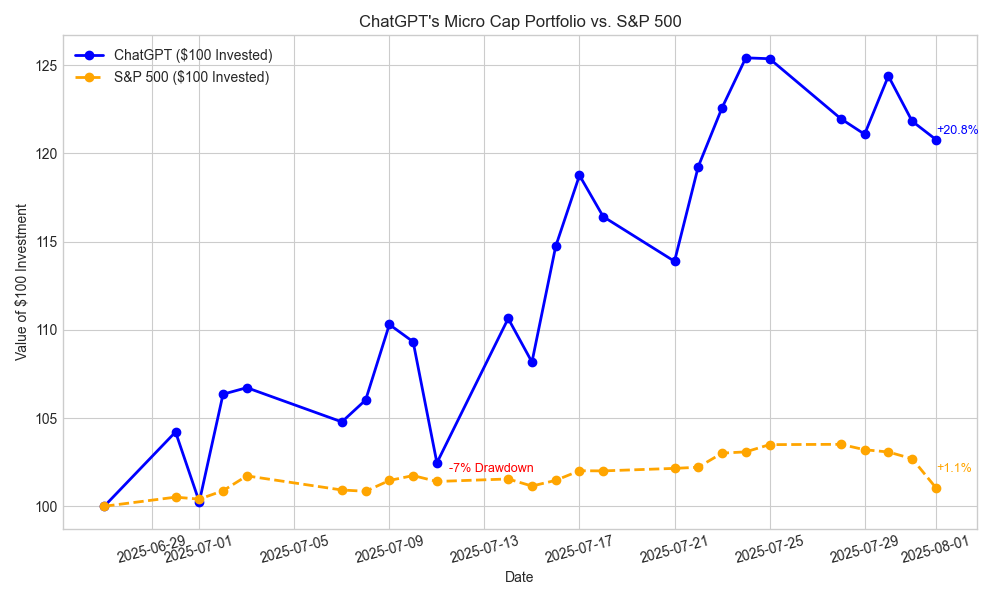

Performance Graph

Overall Sharpe Ratio: 0.8803~

Overall Sortino Ratio: 1.8735~

Judging purely downside risk, the model is doing solid. Who’s really surprised it has high volatility in general?

Unfortunately, on Friday, I got my tabs switched up and used the same chat for debugging. I didn’t ask it about anything financial (data, indictors, potential picks, etc.); it was just me struggling with Pylance’s stupid type checker. But still that’s unacceptable, and I exited the chat immediately and created a different one going forward. The new chat is where the Deep Research report came from.

Unfiltered Chat Log Starting Wednesday ending Friday: here

Portfolio Review

To see the full report: Click Here

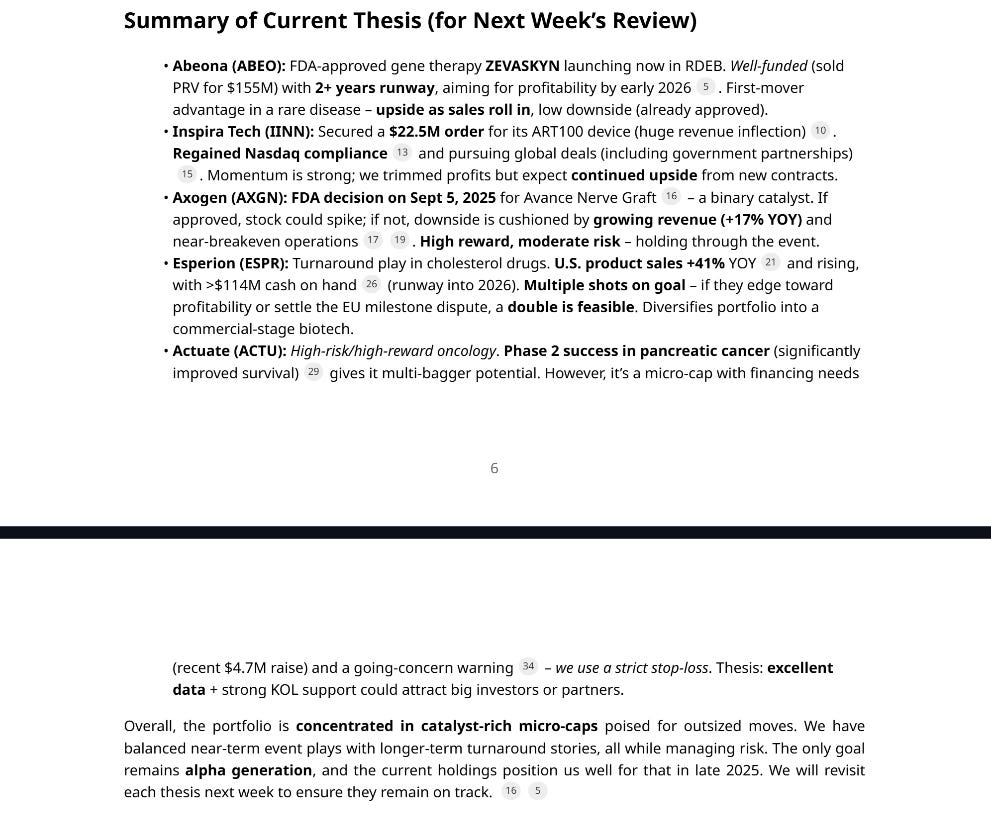

Here was this week’s revaluation summary:

My Thoughts

I love the idea for this new model to carry on last thesis. I’m not sure why it loves IINN so much, because it’s only ever bled money. Also, it definitely isn’t considering macroeconomic/sector wide factors for BioTech, considering the industry’s extremely fragile outlook. The model is still performing at a high level, so only time will tell.

I will edit the deep research prompt going forward to gather real portfolio information, because most of the time it will just research picks. Will be posting the complete chat log next week, so stay tuned! Can ChatGPT make alpha on the edge of total market recession? Subscribe to stay tuned every week!

GitHub Page and Email:

To see past deep research reports and summaries: Click Here

Have a question? Check out: Q&A

Disclaimer: Here

If you’re curious about the code I’m using to automate results and graph, the GitHub page is: ChatGPT-Micro-Cap-Experiment

If you have any suggestions or advice, my Gmail is : nathanbsmith729@gmail.com

Very interesting. I've just started something similar, with the research part sorta automated via Gemini API. Curious to see how it continues.

Very interesting work! I too am curious about how it will manage a portfolio. I want to run a similar test alongside to see how GPT fares when asked the same by another person, see if the selections differ.