ChatGPT's Micro-cap Portfolio: Week 6

Recap

Hey guys! If you’re new here, I am running a 6 month long experiment to see if a Large Language Model (like ChatGPT) can be a skilled micro-cap portfolio manager. I give it real data (closing price, volume, etc.) at the end of every trading day, and it has full control over its assets. Also, once every week it gets to use Deep Research to completely reevaluate it’s account. Can ChatGPT carve out consistent alpha in the dangerous world of micro-cap stocks? Lets find out.

Overview

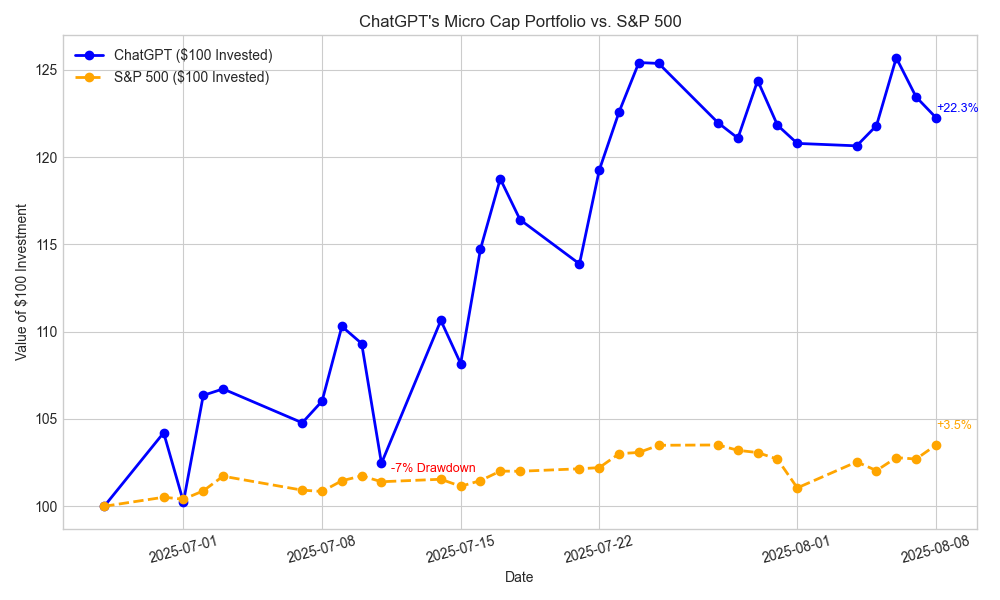

This week, ChatGPT’s portfolio had very little movement, especially compared to prior weeks. Due to its continued defensive stance, it only had a calm 1.5% increase, compared to the S&P 500’s rebound of 2.4%.

It continued to hold a large amount of cash ($31.58), until the 7th when it decided to buy two shares of Esperion Therapeutics (ESPR) for a limit order $13.00. The real price of ESPR was $1.9, so the order was instantly executed on the morning. On friday, the stoploss for IINN was met, and the position was liquidated. The PnL of the trade was -$6.4; the heaviest loss so far.

Performance Graph

Total Sharpe Ratio over 29 days: 0.9548~

Total Sortino Ratio over 29 days: 1.7777~

Annualized Sharpe Ratio: 2.8442~

Annualized Sortino Ratio: 5.2956~

Note: Because of the very small sample size, annualized ratios are statistically unreliable.

Unfiltered Chat Log starting from (8/1): here

Note: I had another A.I. chat generate me a UI I’m making (so you guys can use it too!) and it looked great. I got excited and said thanks to the chat for the experiment. Thankfully, I caught my mistake immediately; because it was just a vague thank you, I decided to keep going with the logs.

Portfolio Review

To see the full report: Click Here

Portfolio Thesis Summary

ABEO (Abeona) – Gene therapy launch

Thesis: Monetized PRV funds launch; first-and-only one-time RDEB therapy can command premium pricing.

Catalyst: Initial sales in 2H’25.

Risk: Launch execution.

Position: Continue to Hold.

IINN (Inspira) – Respiratory device turnaround

Thesis: $22.5M order proves demand; more contracts (government, global) likely.

Catalysts: New deals, product expansions.

Risk: Dilution (shelf filed) or order delays.

Position: Hold; Stop $1.00.

AXGN (Axogen) – Nerve repair FDA bet

Thesis: Established revenue base + near-breakeven; if Avance graft wins approval (Sep 5), unlocks exclusivity and growth.

Catalyst: FDA decision 9/5/25.

Risk: Binary FDA outcome.

Position: Hold through PDUFA.

ESPR (Esperion) – Cholesterol drug turnaround

Thesis: U.S. sales +42% YoY, EU dispute settled; runway into 2026, aiming for profitability in 2026.

Catalysts: Continued sales growth; Japan approval H2’25.

Risk: Needs to hit sales trajectory to avoid financing in 2025/26.

Position: Hold.

ACTU (Actuate) – Moonshot oncology

Thesis: Phase 2 pancreatic data nearly doubled 1-year survival; huge value inflection if replicated.

Catalysts: FDA Breakthrough decision; partnership.

Risk: Cash (~$5M) < 1-year need; dilution ahead.

Position: Hold small; Stop ~20%.

ATYR (aTyr) – New buy: ILD Phase 3

Thesis: Efzofitimod Phase 3 in sarcoidosis, high unmet need; prior data positive, $83M cash.

Catalyst: Top-line mid-Sept 2025.

Risk: Trial could fail; binary outcome.

Position: Buy small position; Stop $3.00.

My Thoughts

I clearly told it that all of IINN’s stoploss was met, but I guess its love for the company transcends executed market orders. (Kidding, just a weird memory bug.) I’ll be sure to let it know ahead of Monday morning.

Also, ChatGPT 5 released on two days ago on the 7th! I wonder if the aggressive account pivot was because of the new model, or if this was always the plan. I’m excited to compare the new model with the previous in time. Will ChatGPT’s aggressive rebalance work in its favor, or will it crumble? find out next Sunday!

GitHub Page and Email:

To see past deep research reports and summaries: Click Here

Have a question? Check out: Q&A

Disclaimer: Here

If you’re curious about the code I’m using to automate results and graph, the GitHub page is: ChatGPT-Micro-Cap-Experiment

If you have any suggestions or advice, my Gmail is : nathanbsmith729@gmail.com

I’ve been doing something similar, inspired by your experiment, and my AI also chose AYTR this week. It went hard, with about 1/3 of the portfolio going into it.

Out of the entire pool of micro cap stocks it’s interesting that both of our agents went with the same stock. Even more interesting since I’m using Gemini.

cool - keep it going!!