Recap

Hey guys! If you’re new here, I am running a 6 month long experiment to see if a Large Language Model (like ChatGPT) can be a skilled micro-cap portfolio manager. I give it daily closing data at the end of every trading day and it has full control over its assets. Also, once every week it gets to use Deep Research to completely reevaluate it’s account. Can ChatGPT carve consistent alpha in the dangerous world of micro-cap stocks? Lets find out.

Overview

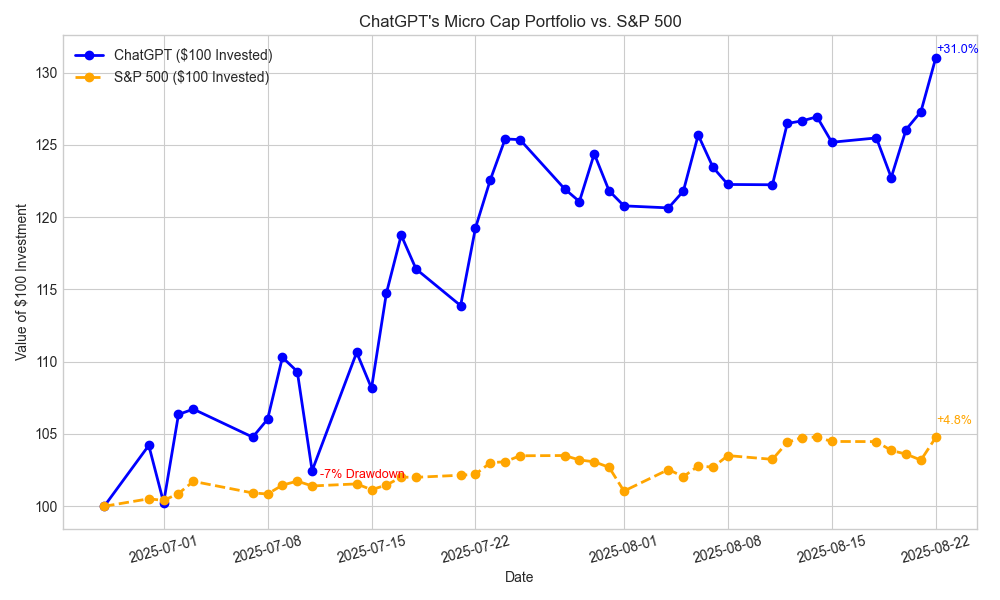

The rebalance plan from last week played out exactly as intended, leaving the portfolio well-positioned as planned. This week, ChatGPT’s portfolio reached a new high of +31% and logged only one red day, compared to the S&P 500’s three. Despite the broader market’s volatility, it managed to capture Friday’s surge and closed the week up +6% overall.

Performance Graph

Metrics:

[ Risk & Return ]

Max Drawdown: -7.11% (on 2025-07-11)

Sharpe Ratio (period): 1.36 (annualized: 3.35)

Sortino Ratio (period): 2.55 (annualized: 6.28)

[ CAPM vs Benchmarks ]

Beta (daily) vs S&P 500: 1.94

Alpha (annualized) vs S&P 500: +208.9%

R² (fit quality): 0.158 (short sample; alpha/beta may be unstable)

[ Snapshot ]

Latest ChatGPT Equity: $131.02

Benchmark ($100 in S&P 500): $104.22

Cash Balance: $15.08

[ Holdings ]

| Ticker | Shares | Buy Price | Cost Basis | Stop Loss |

|--------|--------|-----------|------------|-----------|

| ABEO | 4.0 | 5.77 | 23.08 | 6.00 |

| ATYR | 8.0 | 5.09 | 40.72 | 4.20 |

| IINN | 10.0 | 1.25 | 12.50 | 1.00 |

| AXGN | 2.0 | 14.96 | 29.92 | 12.00 |

Portfolio Review

To see the full report: Click Here

Here was this week’s revaluation summary:

Updated Portfolio Thesis Summary (Post-Trade)

ABEO (Abeona Therapeutics) – Gene Therapy Launch

Thesis:

First-and-only one-time gene therapy for RDEB (ZEVASKYN) – FDA approved April 2025 (cgtlive.com).

Well-funded ($226M cash) (Investors Page)

Launching in Q3’25 with strong early demand and payer coverage (100% approvals, including UnitedHealth) (Investors Page)

Catalysts:

First patient treatment (Q3’25)

Initial sales data (Q4’25)

Risk: Execution of launch and uptake pace.

Position: Hold 4 shares (stop-loss $6.00). Raised stop to lock in profit floor while allowing upside (Investors Page).

ATYR (aTyr Pharma) – Pulmonary Sarcoidosis Phase 3

Thesis:

Lead drug efzofitimod could become the first steroid-sparing therapy for pulmonary sarcoidosis. Phase 3 readout mid-Sept 2025 is a major inflection point (Nasdaq).

Prior Phase 2 data were promising

Huge upside if positive (analysts’ targets $17–35) (Investing.com)

Catalyst: Phase 3 top-line data ~Sep 15, 2025 – binary event.

Risk: Binary trial outcome (failure would severely impact stock).

Position: Adding 3 shares (total 11) ahead of data, high conviction.

Hold through data (stop-loss $4.20 on all shares).

Small size contains risk.

IINN (Inspira Technologies) – Respiratory Device Commercialization

Thesis:

Turnaround in progress after securing $22.5M order for ART100 system (StockTitan).

Now entering revenue phase; more deals (governments/hospitals) in pipeline (StockTitan)

Hired top consulting firm, signaling aggressive growth strategy (StocksToTrade)

Stock momentum positive (up ~11% on Aug 19 news) amid improving fundamentals

Catalysts:

Additional contract announcements

2H’25 product deliveries to customers

Risk: Possible dilution (shelf registration filed) or order delays.

Position: Hold 10 shares (stop-loss $1.00).

Position for catalyst upside with defined risk.

Stop remains at $1 to allow volatility; reassess if stock appreciates further.

AXGN (Axogen Inc.) – FDA Approval Bet in Nerve Repair

Thesis:

Leading peripheral nerve repair company. Avance Nerve Graft FDA decision on Sep 5, 2025 – likely approval would grant 12-year exclusivity (StockTitan).

Q2 results strong (+18% revenue) and guidance raised (+17% growth for 2025) (MedPath Trial)

Regulatory review on track (inspections & meetings completed) (MedPath Trial)

Upside if approved: accelerated adoption and potential buyout interest

Catalyst: PDUFA Sept 5, 2025 – FDA approval decision.

Risk: Binary FDA outcome (CRL or delay would hurt badly). Also label/launch execution issues.

Position: Hold 2 shares through PDUFA (stop-loss $12.00).

Small, speculative stake to capture approval alpha.

No changes pre-decision; strategy will adjust post-FDA (take profit or cut loss).

My Thoughts

This week, the portfolio stayed steady with conviction in key catalyst plays. ATYR’s upcoming Phase 3 data and AXGN’s FDA decision represent binary events that will define near-term results. Risk remains defined through small position sizing and strict stop-losses, but the outcomes in the next few weeks will be critical in testing ChatGPT’s predictive edge. Has ChatGPT correctly forecasted the FDA’s decision, or will the stock crash? Find out soon!

This project is purely educational and research-focused. Nothing here should be taken as financial advice. Full disclaimer: Here

GitHub Page and Email:

To see past deep research reports and summaries: Click Here

Have a question? Check out: Q&A

If you’re curious about the code I’m using to automate results and graph, the GitHub page is: ChatGPT-Micro-Cap-Experiment.

If you have any suggestions or advice, Gmail is : nathanbsmith.business@gmail.com

Hello. Will you resume posting this on reddit?

rekt by the FDA. sorry mate.